News

Workshop on GST Annual Return

Ms. Anindita Chatterjee, Partner and Deputy CEO of TCN Global and Economic Advisory Services LLP, emphasized the critical importance for registered taxpayers to exercise utmost care when filing GST annual returns. Speaking at a workshop organized by the World Trade Center Mumbai and the All India Association of Industries (AIAI), Ms. Chatterjee highlighted the potential risks of litigation with tax authorities if financial statements, including sales ledgers, purchase ledgers, credit notes, debit notes, and invoices, are not meticulously maintained.

During the workshop, Ms. Chatterjee cautioned that any discrepancies or mismatches found by tax authorities in the GST annual return, if not rectified, could lead to the assumption that the taxpayer intentionally evaded tax. This could result in penalties and interest under Section 74 of the GST Law.

The focus of the workshop was to raise awareness about key considerations while filing the annual return (form GSTR 9) and form GSTR 9C for the financial year 2022-23, with a statutory due date of December 31, 2023. Ms. Chatterjee emphasized the stringent provisions of the GST Law concerning acts intending to evade tax, such as willful misrepresentation of facts and incorrect claims of Input Tax Credit.

She urged taxpayers to view the annual GST return as an opportunity to rectify and declare any errors made during the previous financial year, whether intentional or unintentional. Rectifying excess input tax credit, under-reported transactions, misclassified goods, or any other genuine errors is crucial in ensuring compliance.

Ms. Chatterjee highlighted the significance of GSTR 9C as more than just a compliance document; it serves as a protection shield to rectify past transaction mismatches and discrepancies, providing a defense against queries or scrutiny from tax authorities. She advised all registered taxpayers to utilize this opportunity by filing GSTR 9 and 9C, providing documentary evidence of any discrepancies or mismatches from the previous year's transactions.

The workshop also addressed instances where discrepancies can arise in past transactions, such as mismatches between the value reported in the E-way bill and GSTR1. Ms. Chatterjee recommended proper documentation of such discrepancies in the GSTR 9C reconciliation statement, along with attaching relevant documents.

Furthermore, she stressed the importance of maintaining sales ledgers and purchase reconciliation statements, suggesting the use of vendor memos that include separate lists of suppliers, purchasers, and warehousing agents.

Dr. Vijay Kalantri, Chairman of World Trade Center Mumbai, emphasized the need for the government to simplify tax compliance procedures, particularly for MSMEs, by increasing turnover limits for composition schemes. He recommended adopting a trust-based, simple compliance procedure to reduce paperwork, time, and compliance costs for small taxpayers.

The workshop, attended by members of trade and industry, tax consultants, finance and accounts professionals, and public sector undertakings, aimed to equip participants with essential insights for effective GST annual return filing and audit compliance.

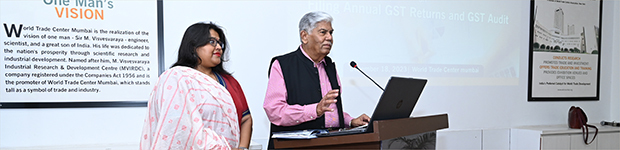

In Photo: Dr. Vijay Kalantri, Chairman of WTC Mumbai addressing the audiance. Also seen in the photo is Ms. Anindita Chatterjee, Partner and Deputy CEO of TCN Global and Economic Advisory Services LLP